Reuters ran an article on the 19th titled “Wall Street’s ‘Buy Everything’ Sentiment Continues” which took as its premise that stock prices in the U.S. are rocketing upwards at an unprecedented pace, and that this, combined with low trading volumes and high levels on the VIX index, means that stocks are “due for a correction”. They quote only one person in the article, Paul Mendelsohn, sage of Charlotte, Vermont. He makes the specific claim that he has “never seen a market like this,” though he has been a “market watcher” for 35 years.

There may be reasonable explanations. Perhaps stocks were too low, so even rising rapidly, they may still be cheap. Or perhaps corporate profitability has increased significantly, so that stocks must rise rapidly to remain fairly valued. Mendelsohn does not consider such issues, saying “I’m showing, by every technical and quantitative standard I have, this market is at extreme levels. But no matter where we start out in the morning, buyers come in.”

Sadly, he doesn’t tell us what “technical and quantitative” standards he has, but the article does give us some clues of what might be worrying Mr. Mendelsohn. It claims that “Trading volume has been exceptionally low recently and the CBOE Volatility Index .VIX, Wall Street’s so-called fear gauge, is up on the week despite the gains in stocks. The index is usually inversely correlated to the S&P 500, and a rise in the VIX typically means a drop in the stock market.”

Hmm.. that sounds wrong.

That goes back as far as Bloomberg has the data, and recent volumes don’t look unusually low to me at all. It looks pretty normal, and that volume data is from the New York Stock Exchange, which has been losing share to competing organizations like Liquidnet for years, so total recent volume is certainly higher.

How about the supposedly torrid pace of stock price increases? Reuters worries that “Wall Street posted its third consecutive week of gains with the S&P 500 now up 6.8 percent for the year and more than 20 percent in just six months.”

How weird is this? Let’s consider the 35 years of Mr. Mendelsohn’s expertise.

It feels hard to panic over that; the current situation looks pretty much like any other bull market. Volume is normal, the pace of increase has plenty of precedent. Through most of the previous periods that looked like this, you’d have been very happy to continue to hold the market.

Oh, about the last claim, that an increase in VIX predicts a drop in the stock market? I have heard this from others, and rigorously testing it is complex (what is the proper lag between an increase in VIX and a drop in the market? Do we care about the absolute level of the VIX, or relative changes therein? etc.) However, as a quick check I just ran normalized VIX against normalized SPX (total return), since January 1990, since that’s when Bloomberg’s data for the VIX starts.

There’s no evident pattern there, but even the most mindless chart junky willing to trust a regression line however inappropriate has to accept that the Reuters has this one wrong — the best fit is a positive correlation.

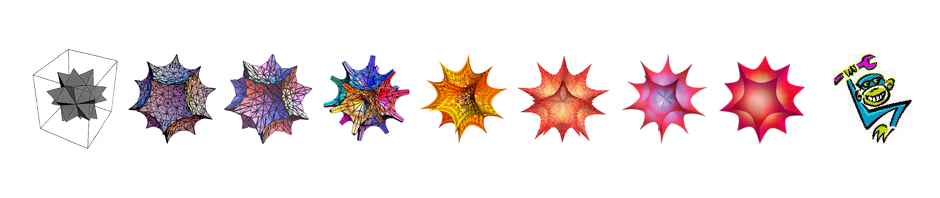

All the graphs above come from Mathematica, using the Mathematica link to Bloomberg. The graphs with the superimposed pink rectangles were a little challenging to make; here’s the source code if you want to do something similar —

rangesAndScale =

Select[Table[{{spxDailyLong[[2]][[i]][[1]],

spxDailyLong[[2]][[i + 33]][[

1]]}, (spxDailyLong[[2]][[i + 33]]/spxDailyLong[[2]][[i]])[[

2]] - 1}, {i, 1,

Length[spxDailyLong[[2]]] - 34}], #[[2]] > .0679 &];

ranges = Transpose[rangesAndScale][[1]];

(* we want overlapping rectangles to be unified into a smaller number of wider rectangles, so we need the following *)

unifier[rangeList_] := Module[{i, outp}, outp = {};

For[i = 1, i <= Length[rangeList], i = i + 1,

If[i < Length[rangeList],

If[AbsoluteTime[rangeList[[i + 1]][[1]]] <=

AbsoluteTime[rangeList[[i]][[2]]],

outp = Append[

outp, {rangeList[[i]][[1]], rangeList[[i + 1]][[2]]}];

i = i + 1,

outp = Append[outp, rangeList[[i]]]

],

outp = Append[outp, rangeList[[i]]]]

];

outp

]

unifiedRanges = FixedPoint[unifier[#] &, ranges] ;

legendRects =

Map[{Pink, Opacity[.5],

Rectangle[{AbsoluteTime[#[[1]]], -100}, {AbsoluteTime[#[[2]]],

1600}]} &, unifiedRanges];

DateListPlot[spxDailyLong[[2]], Frame -> {True, True, False, False},

Epilog -> legendRects,

PlotLabel ->

"\"I've never seen a market like this\"\npink=markets just like \

this (6.78% rise in 34 trading days)"]